CryptoSpace

Top 5 Best Airdrop resources that you don’t want to miss

Published

5 months agoon

By

cryptotapas

This is a guest post submitted on CryptoTapas by BitcoinZ.News

Airdrops are still around in the cryptosphere. Most airdrops are just a waste of time, however, some could turn out to be substantial.

As it becomes difficult to raise money through ICOs or IEOs, more and more projects are choosing airdrops as a way to get traction for their projects.

What are airdrops?

Sometimes, you could get free tokens just for holding some other tokens. If you hold your bitcoin or ethereum in wallets (not exchanges), you could receive free tokens based on a pre-set ratio. For instance, NEO holders received .2 ONT for each NEO held in their wallet.

It’s called airdrop because once the condition is met (holding a certain tokens or subscribing, etc.) you don’t have to do anything to get the tokens, they are automatically dropped into your wallet.

How do companies benefit from airdrop?

Let’s say, you mint 10 Billion in tokens.

These tokens are worthless unless people start using them. Instead of waiting for someone to come to you for your tokens, you give them out for free for them to be used on your platform. This is similar to free sample that traditional companies give out.

Let’s say, you give out 1 billion tokens for free, via airdrops.

And let’s assume, your project is viable and starts gaining traction.

Now, let’s assume each of your tokens is worth 1 cent, because your project has garnered interest in the community.

The value of the tokens you have given away is $10 Million (1,000,000,000 * .01), however, that value was derived because community involvement. Without the free tokens there was a possibility that your project was never going to see the light of the day.

Here is the kicker. The 9 billion tokens that you kept in your own wallets is now worth $90 million dollars.

The community that backed the project by circulating the free tokens and bringing its utility to light gains $10 million as well. Let’s say, you were one of the individuals who got 100,000 of these free tokens, it is now worth $1000, from just one airdrop.

Not all airdrops are worth it

Higher value airdrops get to run out quickly if you are not in the know. And, keeping track of airdrops is a herculean task.

That’s why we have put together some handy resources for airdrops. Bookmark this page and visit at least once a week to see what hot airdrops could be out there. You never know, your 10 minutes could land you on the next ONT. Worse case scenario would be, you will learn about the new projects that are taking shape in the space. So it is not totally a waste of time.

-

Bitcointalk:

Granddaddy of all resources, bitcointalk continues to be the best place to start looking for free airdrops. This is the place where you will find all the projects mentioning about their up coming or presently running Airdrops and Bounties, so that you can keep track of the projects and make the most out of it.

Below is a sample link to one of their airdrops.

-

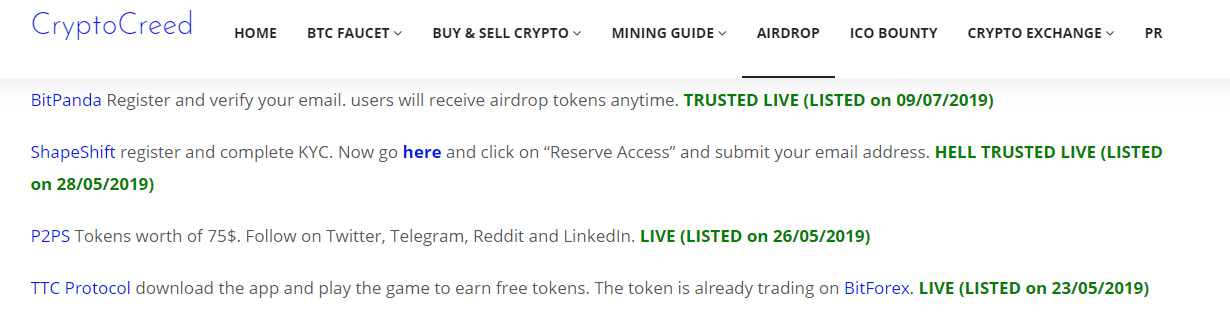

Cryptocreed:

This place is quite similar and well researched on airdrop announcements from various projects and the current status of give away, whether it’s still active or not. And the best part is that, the website shows the rules that needs to be followed to be eligible for the airdrop.Below are the other 3 top airdrop channels which are similar to cryptocreed and they provide the airdrops information from all projects. One can always subscribe to them to get notified when a new project is offering and airdrop.

-

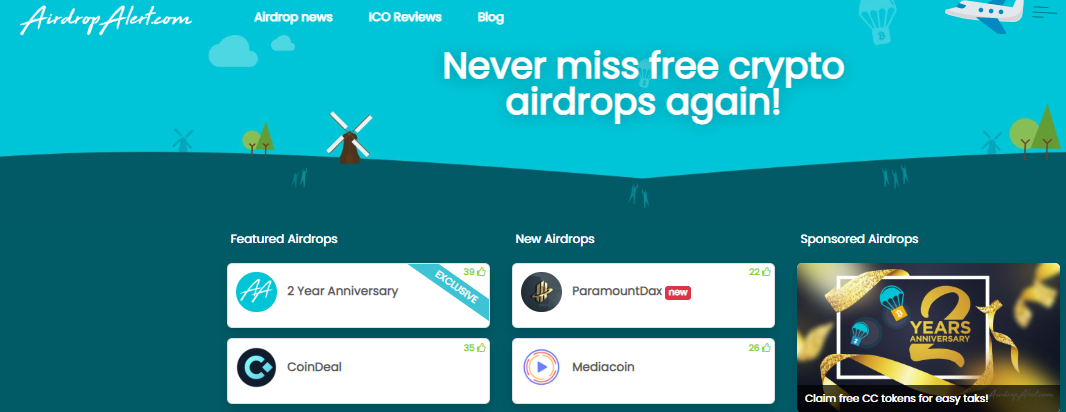

Airdrop Alert:

One of the other website to find the latest airdrop updates is Airdrop Alert. It’s really to surf through various airdrops listed and choose which you would like to opt for.

Not all airdrops are worth wasting your time, so choose wisely.

4. Airdrop Hot List - Telegram

Air drop hot list happens to be the biggest community on Telegram.

5. Crypto Airdrops

Another way to keep track of airdrops is by twitter and Crypto Airdrops provides all the updates.

Airdrops.io is part of this twitter page.

Be Wise:

- Always make sure the airdrops or bounties with their respective official websites or community channels, such as twitter, telegram or reddit.

- Never and ever give away your private keys or seed phrases of your wallets

- When they don’t seem reliable or if their project seems shaby, just exit.

NOTE: We will be updating this article with new resources as and when we find them, so make sure to bookmark this page. If you have good recommendations, let us know in the comments.

Make sure that you have good anti-virus in general to keep trojans and trackers out of the way. We personally use Panda, it is light and doesn’t seem to affect the system performance. Since it is on the cloud, it gets updated with latest malware protection automatically.

Using a browser like Brave browser is also a good option, in our view, when dealing with all sorts of websites as it comes with inherent tracker disabling features.

Want to guest post?

You can submit guest posts to Cryptotapas to get your articles published here. Click here to Guest Post.

Thank you for reading the article.

Everything in this article is an opinion, not an advice of any kind. This material has been prepared for general informational purposes only and it is not intended to be relied upon as accounting, tax, investment, legal or other professional advice. Please consult with a professional for specific advice.

We do not endorse or guarantee the accuracy of the information and claims made.

Buy us a  : Keep information FREE. We do not sell what we research. A small tip from you can help us bring you more content like this for FREE.

: Keep information FREE. We do not sell what we research. A small tip from you can help us bring you more content like this for FREE.

BTC: 37kJr9PodRHzsG5u1ZfKkfYpHFSZrS8s9n

If you are thinking to open KuCoinaccount, please consider using our referral link.

About the author

RK Reddy holds two Masters degrees, one in Accounting and another in Business Administration with over 15 years of experience in the financial services industry.

RK Reddy is an ardent fan of Blockchain and Cryptocurrencies. You can see the excitement about this new blockchain technology in every article on Cryptotapas.com. Sometimes this excitement leads to an overly optimistic view. Guilty as charged. RK Reddy says “what may seem like an ‘overly optimistic expectation’ today may become an everyday norm in 5-10 years; look at the history of cars or airplanes, Blockchain and Cryptocurrencies belong to a similar frame of reference.” Of course, that is just his opinion.

CryptoSpace

Comparing the BEST Cryptocurrency tax software [Updated for 2020]

Published

1 week agoon

November 26, 2019By

cryptotapas

A lot has happened since we wrote our last review on BEST Cryptocurrency tax software in the market for 2019.

Before we get on with our Best Cryptocurrency Tax Software picks for 2020, let’s quickly examine all the things that took place in 2019 (and we haven’t even finished the year yet).

- IRS issued letters to taxpayers with crypto transactions from 2014 through 2017, here is an article on what to do if you received the IRS letter 6173 or 6174

- IRS issued new guidance on how to tax crypto hard forks and airdrops

- IRS Cyber Crimes leaked report revealed the measures that the agency is ready to take to go after crypto tax evaders

- Cryptocurrency held in foreign crypto exchanges is exempt from FBAR reporting, with one exception

All these developments indicate one thing: taxpayers with cryptocurrency transactions can no longer hide under a rock and hope for the best.

All of these transactions trigger a taxable event

Many taxpayers who have received the IRS tax letter were surprised. Taxpayers who assumed that crypto to crypto transactions were outside the purview of the IRS capital gains tax were among those who were served these letters.

All of the below transactions trigger a tax event:

- Selling or exchanging cryptocurrency for another cryptocurrency (or for FIAT)

- Buying goods or services using cryptocurrency

- Cryptocurrency received through a hard fork creates a tax event

- Cryptocurrency received through airdrops creates a tax event

- Receiving wages in cryptocurrency is a taxable event

- Receiving rental income, royalties, tips, commissions, or any type of income received in cryptocurrency is a taxable event

- Any exchange of value using cryptocurrency instead of fiat creates same taxable event as if fiat was used

Do you need a cryptocurrency software?

If all of your cryptocurrency transactions were in one or two exchanges, like Coinbase, that provides clean tax documents with all your transactions, then you may not need a crypto tax software.

However, trouble creeps in when you have:

- transactions over multiple exchanges

- movement of crypto funds from one exchange to another

- received hard forks

- traded extensively in cryptocurrencies during the year

- moved funds from wallet to exchange or vice-versa

We have observed that whenever you have transactions in more than one crypto exchange, it is a big time saver to use crypto tax software.

Key attributes to look for in your cryptocurrency tax software

For the purpose of our comparison, we will be looking at the following aspects for each crypto tax software and then we will compare them against each other.

- Exchanges supported and wallet imports: If you have dealt with multiple exchanges and wallets during the year, you want to make sure that the crypto tax software that you pick has the best coverage, even if this means you have to shell out a few extra $$s. Trust us, from our own experience we can say, it is worth the peace knowing that the software does the job for you.

- Tax computation methods: First In First Out (FIFO) or Last In First Out (LIFO) are the most popular tax methods in the US with FIFO considered most conservative. There is also another option to identify specific coins for specific transactions but that requires meticulous documentation. Most crypto tax softwares support FIFO and LIFO along with other methods that may be used by other countries. Make sure you consult a tax professional to ensure you are picking the right tax method for you and the one that is allowed by the tax authorities.

- Tax forms support: The IRS requires taxpayers to differentiate between their short-term and long term capital gains. These are reported on different sections of the Form 8949. Crypto tax software that can sort the information on the proper forms is the one you want to use. Also, some crypto tax software facilitate the direct import of these transactions to tax platforms like TurboTax.

- Pricing options: Bear market has killed a million dreams in the crypto space. Last thing people want is to shell out too much dough on buying a tax software. However, as much as it is important to keep track of your gains, it is equally important to keep track of your losses so you can offset them on a future gain. Best crypto tax software for your situation will depend on how many exchanges you have used, number of transactions, losses you have incurred during the year, scams you have endured and many such factors.

- FBAR support: The US Treasury has confirmed that foreign cryptocurrency exchanges need not be disclosed under the Foreign Bank Account Reporting (FBAR) regulations on FinCEN Form 114. However, there is a catch regarding having transferred any fiat during the calendar year to any foreign crypto exchange that could trigger a FBAR filing requirement.

- Customer support: You also want to pick the crypto tax software that responds to your needs in case you run into any trouble.

Having looked at the key attributes, let’s look at popular crypto tax softwares on the market:

Following review is an opinion. We presented the criteria that we would personally look for in a crypto tax software based on our needs. Your needs may be different. We have not used all of these software, and where applicable, we have formed opinions based on information available publicly. We may be compensated for the referral links, no other financial arrangement exist between these companies and us.

Cointracking.info

In our opinion, Cointracking continues to be one of the most popular crypto tax software. It offers most number of tax computation methods in the market. It can get easily overwhelming to see the number of options available, however, not all options are relevant to the US and being a global crypto tax software tool - making these options available is important for other jurisdictions.

From a mere updates and staying ahead perspective, Cointracking has no rival in our opinion. For instance, Cointracking already has the ability to support Binance US, supports Kraken’s credit transactions, and much more. However most taxpayers may not need as savvy a product as Cointracking if they only dealt with one or two exchanges and have few transactions.

Exchanges supported and wallet imports: Cointracking probably has one of the most comprehensive list of exchanges and wallet imports. It supports almost all exchanges and wallets, including hard wallet imports from Trezor.

Tax Computation methods: Cointracking supports FIFO, LIFO, Adjusted Cost base (Canada), HMRC (UK only) along with eight other methods, totalling to 12 methods. For US tax purposes, the most common methods used are FIFO and LIFO.

Tax Forms support: Cointracking generates multiple tax reports for you to use depending on your need, including, 8949 PDF, 8949 CSV download, excel & PDF download of transactions itself, etc., In addition, Cointracking has direct export option to export data to TaxACT, TurboTax and Drake tax software.

Pricing options: Cointracking offers multiple price options depending on your needs. For instance, if you have less than 200 transactions, you can use their FREE option. If you have less than 3500 transactions, their PRO version that costs $118 for 1 year, $201 for 2 years and $369 for lifetime. For traders with transactions exceeding 3500, an unlimited version is available that costs: $251 for 1 year, $402 for 2 years and $2837 for lifetime; Most unique feature about Cointracking is that you can pay the fees with 50 different altcoins in addition to PayPal, credit cards, wire transfers, etc., Users who pay the fees using Bitcoin receive a 5% discount (talk about facilitating adoption!).

| Cointracking.info | |||

|---|---|---|---|

| Plan | Duration | Transactions Supported | Cost in USD* |

| Pro | 1 Year | 3500 | $118 |

| Pro | 2 Years | 3500 | $201 |

| Pro | Lifetime | 3500 | $369 |

| Unlimited | 1 Year | Unlimited | $251 |

| Unlimited | 2 Years | Unlimited | $402 |

| Unlimited | Lifetime | Unlimited | $2837 |

*As of October, 2019

FBAR support: Cointracking does not offer FBAR support. However, if you have never transferred FIAT into a non-US crypto exchange, you may not have an FBAR reporting requirement, as clarified by the FinCEN.

Customer support: You can quickly raise a support ticket on Cointracking portal. We are not sure how we feel about the customer support with Cointracking. They don’t list a phone number and since its a ‘reporting’ tool, there is no real need for an ‘emergency’ line, so it may not be a big deal in our opinion. Rating: OK.

- Lifetime plans make this unique offering

- Price options that fit most needs

- Comprehensive solution

- Multiple tax calculation methods that meet multiple jurisdiction requirements

- No FBAR support

- Customer support connectivity is not as good as other platforms

CryptoTrader.Tax

CryptoTrader also publishes guides on various aspects of cryptocurrency taxes.

Their customer care is amazing. They check in on you after you sign up and take your feedback seriously.

One of the unique features of CryptoTrader is that it helps you go back to previous tax years to pull information if you are looking to amend your previous year tax returns to report crypto transactions.

We had the unique opportunity to talk to David Kemmerer, CEO of CryptoTrader.Tax, about their platform. In his own words, “CryptoTrader.Tax is simply the most accurate crypto tax calculator on the market. This is a direct result of the years that we’ve spent developing our historical pricing engine. It puts us far ahead of the competition, and our users notice.”

If we were to choose between Cointracking and CryptoTrader for customer support alone - we would pick CryptoTrader. And if you have less than 1500 transactions during the year - CryptoTrader is a clear winner from the price point, in our opinion.

- Exchanges supported and wallet imports: CryptoTrader supports a lot of exchanges and where a crypto exchange is not supported, they allow CSV imports, so you are covered even if a direct API import is not available. They support over 35 leading Exchanges (and for the exchanges that they do not have native support, you can manually upload the CSV template) and almost all wallets.

- Tax computation methods: They support LIFO and FIFO methodology. They also support Adjusted Basis method for Canada taxpayers.

- Tax forms support: CryptoTrader supports 8949 functionality for the US taxpayers and it also has TurboTax Integration on all its plans. 1 year money-back guarantee they offer shows the confidence they have in their product.

- Pricing options: From a price point of view, Cointracking and CryptoTrader are in similar ball park when it comes to its Unlimited transactions plan. For taxpayers with less than 1500 transactions, CryptoTrader is a no-brainer, in our opinion.

Cryptotrader.tax

Plan Duration Transactions Supported Cost in USD*

Hobbyist 1 Tax Year 100 $49

Pro Trader 1 Tax Year 1500 $99

High Volume Trader 1 Tax Year 5000 $199

Unlimited 1 Tax Year Unlimited $299

*As of October, 2019

- FBAR support: CryptoTrader does not offer FBAR support. However, if you have never transferred FIAT into a non-US crypto exchange, you may not have an FBAR reporting requirement, as clarified by the FinCEN.

- Customer support: The team responds to questions quickly. They even check-in to see how you are doing during the early days of subscription. Messages on the chat window on their website get answered in under 5 minutes (we tested this on a weekend, and still got a response). Rating: Excellent.

- Excellent customer care

- Simple to use solution

- Their unlimited pricing option is on par with CoinTracking.info

- 1 year money back guarantee

- No FBAR support

- Not as comprehensive Exchange API list as other solutions

TokenTax.co

Exchanges supported and wallet imports: Token Tax boasts support to a massive list (over 260) of crypto exchanges and where an API is not supported, they have the CSV upload option.

Tax computation methods: According to this demo video, TokenTax supports 4 types of tax methods: FIFO, LIFO, Minimization and Average Cost.

Tax forms support: Form 8949 is supported and Direct export to TurboTax is available as well.

Pricing options: Price depends on whether you choose a self serve model or CPA assisted model. The price range starts from $65 and goes up to $1999. The gold option includes IRS audit assistance.

Tokentax.co

Plan Duration Transactions Supported Cost in USD*

Basic 1 Tax Year 500 $65

Premium 1 Tax Year 3000 $199

VIP (CPA Assisted) 1 Tax Year 20000 $1499

Bronze

(Full tax filing)1 Tax Year 3000 $499

Silver

(Full tax filing)1 Tax Year 3000 $999

Gold

(Full tax filing)1 Tax Year 20000 $1999

*as of October 2019

- FBAR support: TokenTax offers FBAR assistance, for the basic and premium plans there is an additional charge of $50, other plans carry unlimited FBAR support.

- Customer support: Probably the only site that actually lists a phone number on the website and their chat boasts to answer messages in under 5 minutes. Rating: Excellent.

- CPA assistance available

- IRS audit assistance in premium plans

- Customer care that includes chat and phone options

- Pricing options are bit expensive, in our opinion

- No unlimited transaction plans

Cointracker.io

Over 10 BILLION in transaction volume has been tracked on Cointracker. They boast a massive $200 Million losses claimed through their platform.

Unlike other tools on this list, Cointracker made it easy to access the data from the exchanges. We tried to connect Coinbase account and instead of asking for API and other complex process, it simply asked us to login to Coinbase account and that’s it. Definitely easier way to connect exchanges to the account.

Cointracker also provides PREVIEW TAX IMPACT feature where you can check the tax impact before you execute a transaction.

They are working on integration of non-crypto accounts to the platform and provides tax loss harvesting and dollar cost averaging features.

- Exchanges supported and wallet imports: Cointracker helps you sync with over 300 exchanges and supports many wallets including hard wallets like Trezor and Ledger. Cointracker supports over 2500 cryptocurrencies. When we tried to connect Coinbase.

- Tax computation methods: Cointracker offers FIFO, LIFO, HIFO, Adjusted Cost Basis, Share pool methods to calculate capital gains.

- Tax forms support: Cointracker supports Form 8949 reporting as well Sch D. In addition, TaxAct and TurboTax exports are available as well.

- Pricing options: Pricing ranges from $49 to $999. They do not have an unlimited plan.

Cointracker.io

Plan Duration Transactions Supported Cost in USD*

Hobbyist 1 Tax Year 100 $49

Trader 1 Tax Year 1500 $199

Pro 1 Tax Year 5000 $499

Satoshi 1 Tax Year 15000 $999

*As of October, 2019

- FBAR support: Cointracker offers FBAR/FATCA support.

- Customer support: They have a chat widget on their portal and promise to respond within a day. We did not find a direct customer care line on the main site or inside the login area. Rating: OK.

- Experience of over 10 Billion in transaction volume

- Over 300 exchanges supported

- No immediate customer support

- Pricing options are bit expensive, in our opinion

ZenLedger.io

The tool offers a full range of support from audit report to calculating crypto income to mining/donation capture, ICO/Airdrops support, Tax Loss Harvesting (tracking losses in crypto and offsetting them against regular stock trades, and loss carry forward).

ZenLedger also supports FinCEN/FBAR alert.

Exchanges supported and wallet imports: ZenLedger has focused on US taxpayers from the get go. Their list of exchanges may not be as impressive as Cointracking or TokenTax but most taxpayers do not deal with as many exchanges, and ZenLedger does cover major ones. For the ones that they don’t cover, they offer CSV upload.

Tax computation methods: FIFO and LIFO are the methods that are available, however, they may consider adding specific identification once the rules are clarified by the IRS.

Tax forms support: Zenledger offers 8948, Sch D and FBAR/FinCEN support through their platform.

Pricing options: ZenLedger has picked up a lot of buzz. This becomes evident from their change in fees structure. Last year, they had 3 pricing plans and one of them was FREE. They no longer offer free plan and now have 4 tiers.

Zenledger.io

Plan Duration Transactions Supported Cost in USD*

Starter 1 Tax Year 500

($50K total asset value)$149

Premium 1 Tax Year 1000

($300K total asset value)$399

Executive 1 Tax Year 4000

($1M total asset value)$799

Unlimited 1 Tax Year Unlimited $999

- FBAR support: ZenLedger was among the first ones to provide FBAR/FinCEN alerts. They continue to support the FinCEN alerts in their tool.

- Customer support: Like TokenTax, ZenLedger has chat option that promises to reply in under 5 minutes. We tested this and Pat Larsen, CEO, answered our question on the chat. They don’t have a customer support number but there is an email to reach out to the team. Rating: Excellent.

- ICO/Airdrop Assistance and Tax Loss harvesting features

- US focused

- Easy to reach customer support

- Limits on number of transactions and asset value

Bitcoin.Tax

- Exchanges supported and wallet imports: Bitcoin.Tax offers support for over 20 exchanges, with the option of uploading data from any exchange using a CSV format.

- Tax computation methods: Bitcoin.Tax offers FIFO, LIFO, average cost methods to calculate capital gains.

- Tax forms support: Forms 8949, 8824 are supported in addition to direct import to TurboTax and TaxAct.

Pricing options: For individuals, price starts at $29.95 and for traders price starts at $99.

Bitcoin.tax

Plan Duration Transactions Supported Cost in USD*

Individual 1 Tax Year 10,000 $29 to $49

Trader 1 Tax Year 1,000,000 $99 to $399

*as of October 2019

- FBAR support: No FBAR support on the platform.

- Customer support: Bitcoin.Tax has FAQs listed on their website and if the question you are looking for is not answered, they give you an option to email them which they revert back within 2 business days.

- Simple interface

- Great option for people with fewer transactions

- Budget solution

- Heavy reliance on CSV imports

- Customer care is not one of the best (compared to others on this list), in our opinion.

Which crypto tax software to pick based on price?

In our opinion, if price and value is a factor - then Cointracking.info and CryptoTrader.tax emerge as clear choices.

Under 200 transactions CoinTracking at $0

Upto 3500 transactions: CoinTracking at $118 for 1 year ($369 for lifetime)

Unlimited transactions: CoinTracking at $251 for 1 year ($2837 for lifetime)

Unlimited Transactions, excellent customer care and competitive pricing: CryptoTrader.Tax at $299

Which crypto tax software to pick based on complexity & price?

COMPLEX: Taxpayers with multiple exchanges, wallets and numerous transactions

In our opinion, Cointracking.info and CryptoTrader.Tax still come up at the top purely based on the cost and the tool efficiency. However, TokenTax.co jumps the ranks because of the extensive exchange list and ease of use, not to mention the customer support.

If you dealt with way too many exchanges that are not supported by Cointracking.info or Cryptotrader.tax, the closest best is TokenTax.co in our opinion.

Please consider using the referral links in this article to avail these discounts:

Cointracking Referral gives you 10% Discount and 5% more if you pay with bitcoin.

Cointracker Referral gives you 10$ Discount

Cryptotrader.tax Referral gives you 10% Discount

Zenledger: Referral gives you 10% Discount

Tokentax: use cryptotapas exclusive discount code “CRYPTOTAPAS” for 10% Discount.

Frequently Asked Questions

Q: The solutions at the top of your list do not support FBAR while others do, why then have you ranked them so high?

Q: Have you focused heavily on pricing in assigning these ranks?

Q: Do you have financial incentive behind these rankings?

IMPORTANT DISCLAIMER

Everything in this article is an opinion, not an advice of any kind. This material has been prepared for general informational purposes only and it is not intended to be relied upon as accounting, tax, investment, legal or other professional advice. Please consult with a professional for specific advice.

We do not endorse or guarantee the accuracy of the information and claims made.

All product and company names are trademarks™ or registered® trademarks of their respective holders. Use of them does not imply any affiliation with or endorsement by them.

CryptoSpace

Should You Invest in a Cryptocurrency Retirement Plan?

Published

1 month agoon

October 27, 2019By

Guest Post

This is a guest post submitted on CryptoTapas.

As our industry evolves and changes the job market changes along with it. While consistent technological advancements usually come with a ton of good, it has also brought as to a point of living in the age of increased uncertainty. Entire professions are dying out and certain technical skills are becoming obsolete.

As the years go by, the concept of job security is fading away slowly which has led to some drastic changes in the way we think about our careers. Modern professionals have more freedom but that freedom comes with a side of fresh responsibilities and difficult choices to make.

In a world of changes and uncertainty, developing a sense of financial security has become an increasingly difficult task. So if we’re losing all of these assurances about our work life, what does that mean for the ways we save for a time after our careers have ended?

How to Retire In This Day and Age?

The increase in average life expectancy has made the task of setting aside sufficient income for retirement more challenging and people are not getting ready. A recent survey has shown that only 10% of the people in the US have a formal retirement plan set up and the idea of working after your statutory retirement age is becoming a real strategy for many.

Those who are trying to achieve financial independence usually have a better understanding of their finances. They are probably more likely to stay up with the current trends in the business world and one of the biggest current trends is, of course, cryptocurrency.

In recent years, cryptocurrency has become a dominant topic all over the world, consistently raising more and more attention from potential investors. No one knows what the future will bring for sure yet many believe that we’re still in the early stages of the cryptocurrency era. But could it be a strong asset to your retirement plan?

3 Ways of Developing a Retirement Plan That Includes Cryptocurrency

An SDIRA is a specific type of individual retirement account provided by trustees or custodians. It allows you to hold various investments within your account. Things like stocks, gold, real estate and more importantly, digital currency.

Self-directed IRAs that can hold cryptocurrency are also known as Cryptocurrency or Digital IRAs. A key distinction between a self-directed and a traditional IRA is that an SDIRA is managed by the account holder. This will help you gain greater control over your finances and future, but it does come with some extra responsibilities.

If all of this sounds like a whole lot of work to you, there are simpler ways of approaching the matter. There is an increasing number of companies that specialize in combining cryptocurrencies with your individual retirement accounts. Even though this would make the process a lot easier, it does come with additional fees.

Lastly, there’s always an option of investing in crypto as a way of saving money but without merging it with your official retirement plan. It might be less of a hassle but you will miss out on the tax benefits. Even though we consider it digital currency, the IRS still treats crypto as property which is why you should learn about crypto taxes if you plan on taking this route.

The Upsides

-

It’s a Way of Diversifying Your Portfolio

There have been some success stories in recent history where people went with the cryptocurrency retirement plan and came up on top. In 2017, a physicist who educated himself on the topic of virtual currencies via YouTube invested 15% of his retirement fund and ended up increasing his value nine times. Success stories like this one can make people get very excited but financial advisors still recommend that you should be careful with your investments and make sure to keep them between 5 and 20%.

-

It Allows Tax-Free Growth of Your Cryptocurrency Investments

If you’ve decided to take the route of opening up a Digital IRA then your investments in Bitcoin or any other cryptocurrency will grow completely tax-free. As long as you keep these funds within your account, you are not required to pay any tax fees on them. The only way these funds will become a subject of taxation is when you decide to make a distribution.

-

It Operates Under a Decentralized Infrastructure

One of the main advantages of cryptocurrency retirement savings is that you’re investing in a decentralized infrastructure. Being a part of a system that is independent of centralized institutions comes with the advantages of being unaffected by the actions of central banks and governments.

This is a great benefit because it keeps your investment safe in cases such as bank failures. One of the main reasons for creating a blockchain-based, decentralized cryptocurrency is so that people could avoid being impacted by events similar to the 2008 financial crisis.

Another thing cryptocurrency can save you from is the effects of inflation, in case you’re investing in those that have a hard cap. Bitcoin’s is set at 21 million dollars, meaning no entity will be able to simply invent or print out more and decrease its value.

-

It Has Great Long-Term Growth Potential

Discussing the potential of a relatively new system is a controversial topic but there are certainly reasons why many experts and big company executives believe cryptocurrency has huge long-term potential for growth. A recent comment made by Apple Pay vice president Jennifer Bailey has stirred this discussion even further.

The Downsides

-

It Carries a Lot of Uncertainties

One of the reasons for these discrepancies lies in the fact that certain characteristics of the system are open to interpretation. For example, the volatility of cryptocurrency can be considered to be both a strength and a weakness of the system.

Bitcoin is only just about a decade in existence which is too short of a time-frame to really understand and predict how a financial system will look like in the future.

-

It Has Significant Added Fees

Trading in cryptocurrency through your IRA comes with different types of fees which vary depending on the custodians or trustees providing you with the account. These trading fees usually vary depending on the type of crypto so if you’re considering making an investment, make sure to take these variations into consideration.

-

It Comes with Additional SDIRA-Related Risks

Every self-direct IRA carries specific risks which is something you won’t be able to avoid if you’re looking to maximize the benefits of tax-free growth. The risks come from the fact that SDIRAs have a set of strict rules you must adhere to in order to avoid paying penalties or getting charged with fraud. SDIRAs also come with a set of fees like a one-time establishment fee, a first-year annual fee, annual renewal fee, and fees for investment bill paying.

All of this burden is that much heavier because you have to carry it all by yourself since custodians can’t legally offer financial advice. Finding a good financial advisor is an option but it’s also not very cheap.

Should You Do It?

With everything considered and taken into account, we can certainly say that it’s not the simplest, easiest way nor is it the safest way of setting up a retirement plan. If you’re not even the least bit familiar with cryptocurrency you should probably either figure out another way or look to educate yourself on the subject.

Another thing we can conclude with confidence is that cryptocurrency shouldn’t be considered an all-in strategy, at least for the foreseeable future. The huge potential gains are very exciting but you need to remember what’s on the line.

Those who are uncomfortable with sizable fluctuations in their finances should look to other places to invest their money. Or if you’re close to retirement and don’t have a lot of funds to spare, it’s probably best to sit this one out. Losing your health over the stress of rapid changes in the crypto market is just not worth it.

On the other hand, if you’re still a fairly long way away from getting out of the game and have a few bucks to set aside, cryptocurrency just might be a great thing to try. If you’re smart about it and approach it gradually you can surely set up a scenario where the potential gains drastically outway the potential losses.

Thank you for reading the article.

AuthorBio: Mark is a biz-dev hero at Invoicebus - a simple invoicing service that gets your invoices paid faster. He passionately blogs on topics that help small biz owners succeed in their business. He is also a lifelong learner who practices mindfulness and enjoys long walks in nature more than anything else.

Get weekly IMPORTANT updates right into your mailbox. No more than one email per week.

Save data, time and money by using BRAVE Browser.

Binance now allows Lending with interest rates of up to 15%. Open your Binance account.

Want to guest post?

You can submit guest posts to Cryptotapas to get your articles published here. Click here to Guest Post.

All product and company names are trademarks™ or registered® trademarks of their respective holders. Use of them does not imply any affiliation with or endorsement by them.

IMPORTANT DISCLAIMER

Everything in this article is an opinion, not an advice of any kind. This material has been prepared for general informational purposes only and it is not intended to be relied upon as accounting, tax, investment, legal or other professional advice. Please consult with a professional for specific advice.

This is a guest post. We do not endorse or guarantee the accuracy of the information and claims made.

CryptoSpace

Top 10 Reasons Why Bitcoin Will Outperform Competition

Published

2 months agoon

September 25, 2019By

Guest Post

This is a guest post submitted on CryptoTapas.

Majority of investors are worried about bitcoins growth due to its current market value. Actually, the sluggish performance opposes the good news about its huge growth in the near future. Experts say that the current price appears to be the inaccurate indicator of its expected market potential. However, there is no need to worry about your long-term investments. Yeah! There are few potential reasons that show bitcoin will keep on growing in the competitive market. Go through the article below to know more in this regard.

Top 10 reasons why Bitcoin will outperform the competition:

Here we have listed the top 10 reasons that prove Bitcoin as one of the most profitable investments in the cryptocurrency world:

1. Increasing traffic on bitcoin sites

2. Rise in bitcoin transactions

3. Mainstream coverage in the market

4. Social media hotspot

5. Bitcoin activity on Exchanges

6. Venture capital funding

Stats reveal the impressive performance of Bitcoin in the business industry for the current year. The rising number of bitcoin businesses and increasing venture capital may lead to a valuable impact on the Bitcoin market. Venture capital brings new connections and advises with it, and such updates are more useful for the future growth of this cryptocurrency. Businesses are going to help in growth of Bitcoin infrastructure, and with time, this currency will become easier to sell and buy. Venture capital funding will ensure positive returns with easy investment opportunities in near future.

7. Clarity on regulations

8. Introduction to new financial tools

9. Rise of new bitcoin communities

It is good to know that Bitcoin is now expanding over the world. The grassroot communities these days are working hard to build Bitcoin infrastructure in the market. With the changing scenario, it has now introduced new people to the Bitcoin industry. It seems like the seeds have been planted now and it will show dramatic growth in the near future. The cryptocurrency driven network will sustain in the market for long run.

10. Companies are in search of new talent

The bitcoin companies around the world these days are looking for new talent to ensure growth in the competitive market. Experts believe that new talent is expected to bring connections, knowledge, experience, and legitimacy to the bitcoin market. Many big business tycoons are showing their interest in bitcoin industry; the Silicon Valley veterans and jumping into crypto world. All these aspects show how influential the bitcoin market can be in near future. The Bitcoin movement is expected to change the world by providing new investment and growth opportunities.

With all such positive factors, we can say that bitcoin will definitely outperform in the competitive market, and it will ensure great returns to the investors in the coming years.

Thank you for reading this article.

Get weekly IMPORTANT updates right into your mailbox. No more than one email per week.

Please let us know if we have missed any important news?

Save data, time and money by using BRAVE Browser.

Binance now allows Lending with interest rates of up to 15%. Open your Binance account.

Want to guest post?

You can submit guest posts to Cryptotapas to get your articles published here. Click here to Guest Post.

All product and company names are trademarks™ or registered® trademarks of their respective holders. Use of them does not imply any affiliation with or endorsement by them.

IMPORTANT DISCLAIMER

Everything in this article is an opinion, not an advice of any kind. This material has been prepared for general informational purposes only and it is not intended to be relied upon as accounting, tax, investment, legal or other professional advice. Please consult with a professional for specific advice.

This is a guest post. We do not endorse or guarantee the accuracy of the information and claims made.

Crypto Taxes

Want to Guestpost?

Comparing the BEST Cryptocurrency tax software [Updated for 2020]

Last week crypto news tonight #15

Last week crypto news #14

“Governance is the most valuable innovation [blockchain] space is driving,” Charles Hoskinson at WCC 2019

Last Week Crypto News Today #13

Internet browsing with your star trek sheilds up- Brendan Eich on Brave Browser | WCC 2019

Let us prepare your Crypto Tax Returns!

“Governance is the most valuable innovation [blockchain] space is driving,” Charles Hoskinson at WCC 2019

Last week crypto news #14

Last Week Crypto News Today #12

What happens to Influencers that promoted ICOs and Crypto projects?

ICO Review: Could this be the Internet of Things with Wings (IoTW)?

Why we do not support nor invest in Ripple

Cindicator. Why are we excited about its future and why you should take a note?

Trending

- Blockchain12 months ago

Comparing the BEST Cryptocurrency tax software

- Blockchain12 months ago

Will Security Token Offerings (STO) take over crypto market in 2019?

- News | FOMO | FUD1 year ago

Bull Stampede ahead!

- CryptoSpace1 year ago

Are you a UNITED STATES resident with Binance or KuCoin accounts? Your funds may get FROZEN if you fail this important reporting obligation

- Blockchain1 year ago

82% of the Fortune 100 have explored Blockchain, here are the details!

- CryptoSpace1 year ago

Projects to pay attention to before they breakout (including new recommendation)

- CryptoSpace1 year ago

Cryptos and Movies, an uncanny comparison

- Blockchain12 months ago

“Crypto Investors Need Better Tax and Accounting Tools”, says CEO of ZenLedger

: Keep information FREE. We do not sell what we research. A small tip from you can help us bring you more content like this for FREE.

: Keep information FREE. We do not sell what we research. A small tip from you can help us bring you more content like this for FREE.